BETTING ON THE MARKET

Low risk and stable yield – the holy grail of investment strategy for private equity.

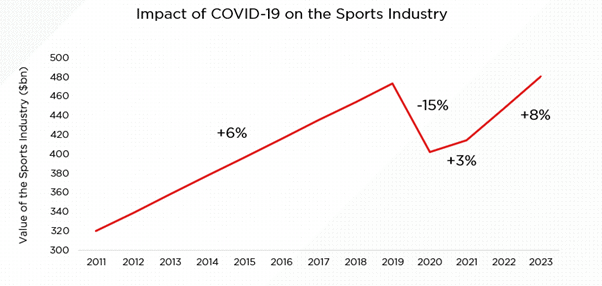

Since 2011 the sports industry has grown 6% year on year, but due to the pandemic this growth has been overturned by event cancellations, a ban of spectators from events, a reduction of grass root level sports, and the closure of retail stores. As a result, there is now a golden opportunity for private equity to invest in the industry.

The sports market has shrunk by a reported 15% since the pandemic began and yet, due to pre-existing strong structural foundations, this turbulence and volatility is only temporary. With an estimated 3% industry growth in 2021 and a further 8% in 2022, the light at the end of the tunnel is clearly visible within the market.

Figure 1: Estimated market size of the global sports industry

The recovery is unparalleled when compared to other investment opportunities that face private equity investors, and there is a compelling case for investors to ‘buy the dip’ and acquire assets within the sports marketplace for a low price that will guarantee strong and steady return on investment for stakeholders.

A COMMERCIAL AWAKENING

Historically, private equity investment has focused its attention away from the sports industry, with capital being distributed to those sporting bodies that individuals have a vested interest in, rather than those that have a compelling business case.

Organising bodies that value tradition over commercial streamlining have widely been ignored by private equity because the roadmap to navigate interest has been seen as too complex to warrant exploration.

Fast forward to today and the landscape is changing. As a direct result of the pandemic, some sporting bodies are struggling to stay financially afloat, and now private equity investors are making headway to overlook the trials and tribulations of creating partnerships with these institutions because the potential for return is too compelling to ignore.

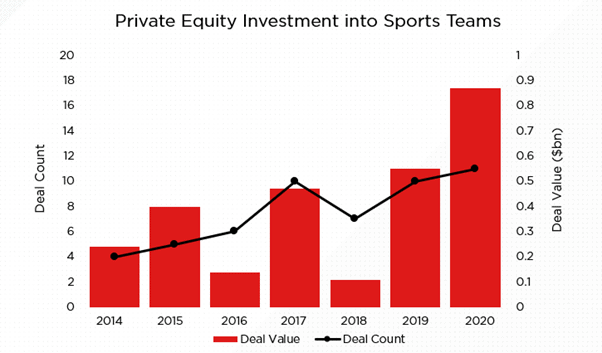

During the pandemic we have seen some large cash injections from private equity into sports, at a time when the potential for returns has been the highest.

Figure 2: Private equity investments into sports teams

MSP Sports Capital, a New York based privately held investment advisory firm, has invested £185m into McLaren Racing, acquiring an initial 15% stake that will increase to a maximum of a 33% shareholding by the end of 2022. MSP invested in McLaren in December 2020 at the height of the pandemic – arguably the best time to invest in a Formula 1 team since the financial crisis in 2007 – due to the lower cost of entry.

New Zealand Rugby is another interesting case study for private equity investment. In early 2021, they agreed to sell to U.S. Private Equity firm Silver Lake – who have also taken a $500m stake in the City Football Group – a 12.5% stake in a company that would control and develop All Blacks’ commercial rights. In return, Silver Lake would invest $273m into the development of the game, both on a local and gloval level via the All Blacks.

These two investments can be grouped together and categorised as yield investments, where both firms have invested at a time of market recession in order to increase their return on investment in years to come.

THE BUSINESS CASE

The opportunities for private equity within the sports landscape is uncapped, and in the current state of the sports marketplace, there is no better time for private equity funds to re-assess their portfolios.

Right Formula’s current work with the United Rugby Championship (URC), backed by CVC Capital Partners, has demonstrated that the rationale for private equity investment is impossible to ignore. There is no other vertical in life that can guarantee a fixed audience of a specific demographic at a pre-determined time and place. This guarantees low risk and stable, sustainable returns for investors.

Figure 3: The United Rugby Championship, backed by CVC Capital Parners

Right Formula believes that the rationale for private equity investment into sports rests on two key pillars which create a compelling case for stakeholders.

UNWAVERING FANS

What cannot be ignored in sport is the connection between a fan and their chosen sports team. This state of mind underpins the entire sports industry, with global reach and engagement of specific sports driving investment from sponsors and broadcasters. No other industry is broken down this way when deliberating investment, however it is sport’s biggest strength as the activity of its following is unparalleled.

For fans, the connection transcends the borders of a sports field and plays a pivotal role in their day to day lives. This makes the commercial model for the sports industry increasingly appealing, as the unwavering support of a lifelong fan for a sponsor can result in lifelong customer support, lower cost per acquisition, lower churn and the creation of genuine brand advocates.

The fans are the ones driving the stability of investment returns in the sports industry, fully encompassing the ethos of ‘if you build it, he will come’. Their unwavering support is what makes the industry as powerful and profitable as it is.

Figure 4: Borussia Dortmund fans – renowned as some of the most passionate in the world

UNIQUE COMMERCIALISATION

The sports industry presents a vast marketplace that has the potential for private equity to break new ground and develop the more established sports. Although the former would appear to be the most profitable due to less clutter, that is not necessarily always the case.

The iconic example for returns on investment in an already established sport is the CVC investment into Fornula 1, where the firm turned a $952m investment in 2006 into more than a $6.7bn exit in 2016. This return on investment has been championed as the ideal case study for private equity to refer to when assessing the sporting landscape.

With the rapid digitalisation of the industry and the growth of new events including the URC, The Hundred, Golf Sixes and the UCI Cycling World Championships, more commercial opportunities are appearing in the most established sports in the industry. These sports have uncapped potential for returns as they are speaking to an incredibly engaged fanbase in a new and diverse way.

THE ROADMAP

The pandemic has forced investors to recognise the commercial opportunities within the sports industry and stable foundations will see the sports market regenerate stronger than ever in the coming years. Now is the time for partnerships to be created to ensure the strongest yields possible.